Hello and welcome to another Bitcoin update. On today’s daily chart, we’ve seen a breakdown from the trend channel to the downside, with price reacting strongly at the 61.8% Fibonacci retracement level ($117,450). This resistance area continues to hold, keeping the orange scenario intact for now.

The Bigger Picture: Seasonality Matters

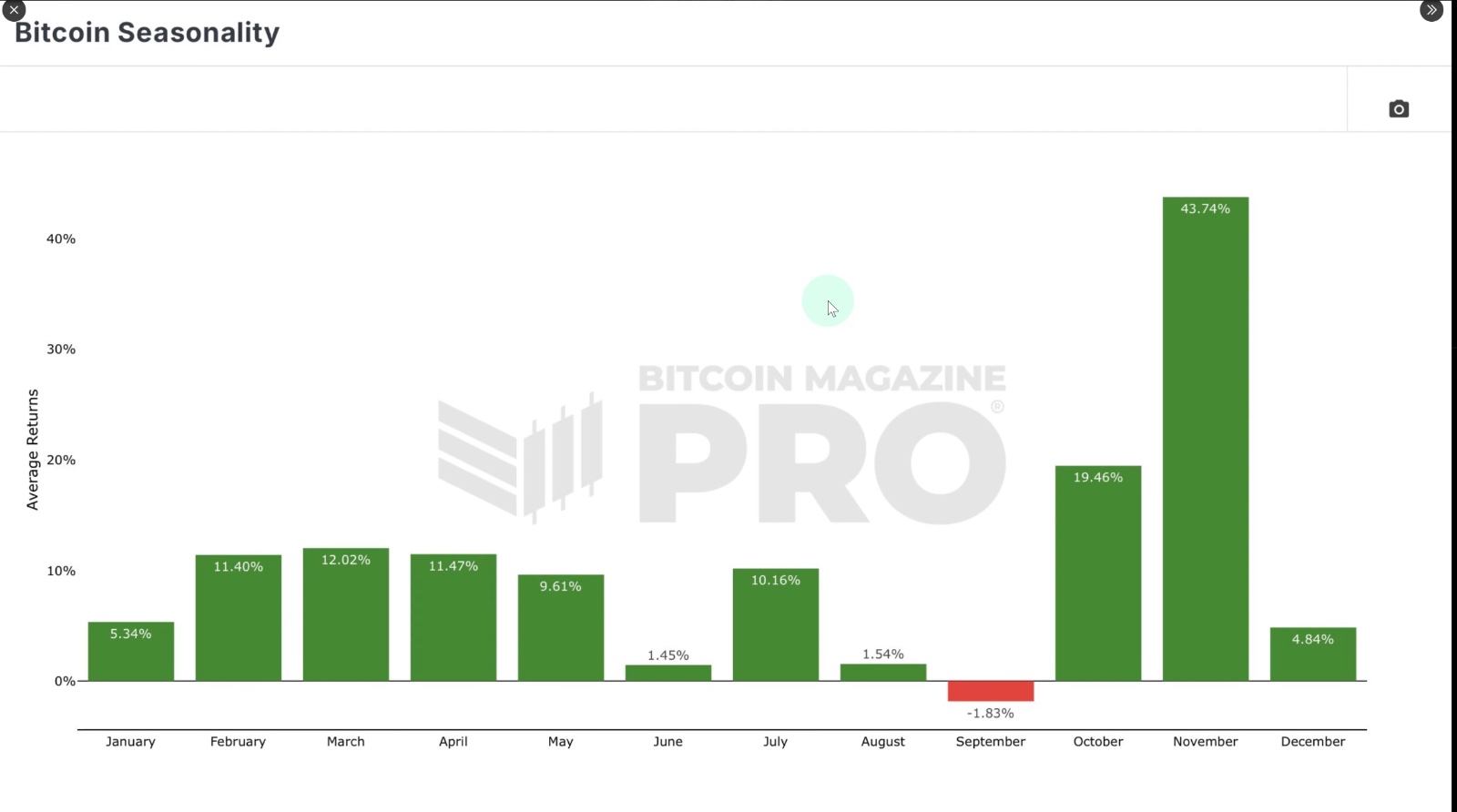

•September remains the weakest month for Bitcoin, especially in post-halving years.

•Historically, October and November tend to be positive months for BTC.

•While this year isn’t an exception so far, it’s worth remembering that seasonality often influences sentiment—whether by self-fulfilling prophecy or embedded market psychology.

So, while September may look weak, the outlook for Q4 remains constructive, with October–November offering strong potential.

Current Scenarios in Play

🔸 Orange Scenario (Preferred for Now)

•With the channel break, the market is likely moving into a C-wave to the downside.

•The ideal target for this move would be the 100% Fibonacci extension (~$101K–$102K).

•Key short-term support zones:

•$112,460 – $109,477 (micro support)

•$107,400 – $105,230 (major support tested in September)

•A decisive break below $109,477 would strengthen the orange count and point to further downside.

⚪ White Scenario (Speculative)

•The white count envisions a potential ending diagonal pattern, which could lead directly to higher prices.

•However, this requires confirmation through a five-wave impulsive move up.

•The first bullish trigger would be a break above $116,250 (last swing high).

•Without a clear five-wave rally, this scenario remains low probability.

Market Structure Check

•At present, the move down is only three waves, not a full five.

•If we get five waves down (orange wave 1) followed by a corrective rally (wave 2), that would further confirm the C-wave decline.

•Conversely, a micro five-wave rally to the upside would suggest the bulls are regaining control.

Key Levels to Watch

•Support:

•$112,460 – $109,477 (short-term zone)

•$107,400 – $105,230 (major structural support)

•Resistance:

•$116,250 (bullish breakout trigger)

•$117,450 (61.8% Fibonacci retrace – holding as resistance)

•Targets:

•Orange scenario → $101K–$102K

•White scenario → Potential breakout toward new highs if bulls reclaim momentum

Final Thoughts

September is once again living up to its reputation as Bitcoin’s weakest month. The breakdown from the channel suggests further downside (orange scenario), but the bulls still have a chance if they can produce a clear five-wave rally.

The next few days will be crucial in confirming whether the market continues lower toward the $101K region—or whether the bulls stage a comeback, setting the stage for a Q4 rally.