Bitcoin Elliott Wave Analysis: Correction Still Unfolding, Key Supports to Watch

Bitcoin’s recent price action continues to signal that the correction is not yet complete. Despite minor bounces, there is still no clear evidence of a bottom, as we haven’t seen a decisive five-wave move higher from any recent low. The market remains corrective, and traders should remain cautious heading into the weekend.

Correction Still in Progress

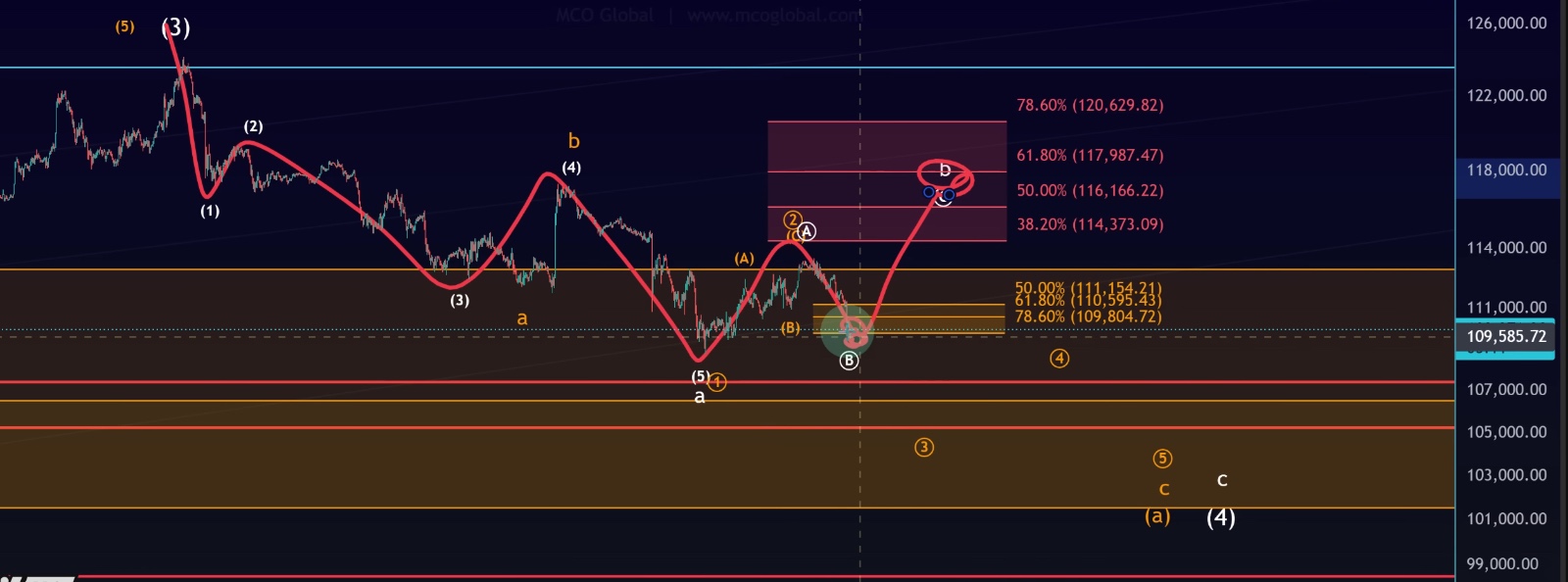

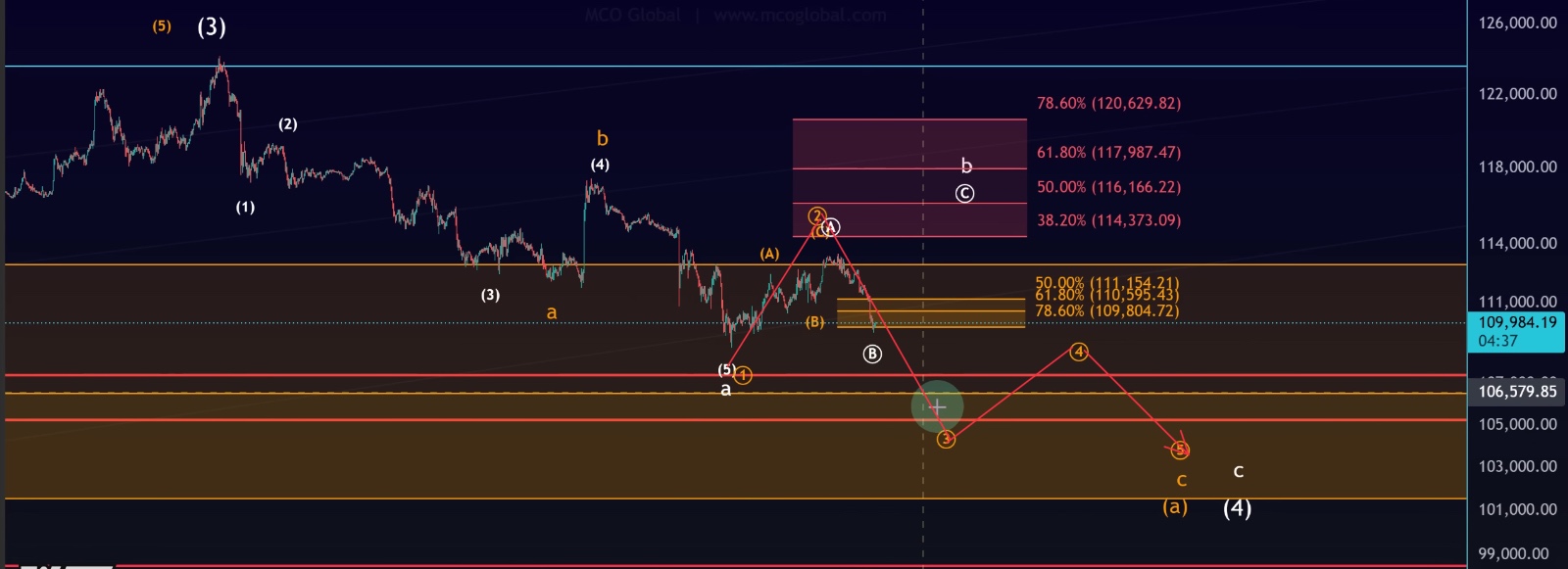

For the past two days, we’ve been highlighting the same idea: this correction is still unfolding. The market structure suggests two possibilities:

1.Wave 4 Correction → Could still lead to a final Wave 5 rally.

2.Extended Corrective Structure → A larger correction continuing to play out, which would delay any significant bullish continuation.

The difference between these two scenarios will only become clear during the next major bounce. For now, the bias remains to the downside.

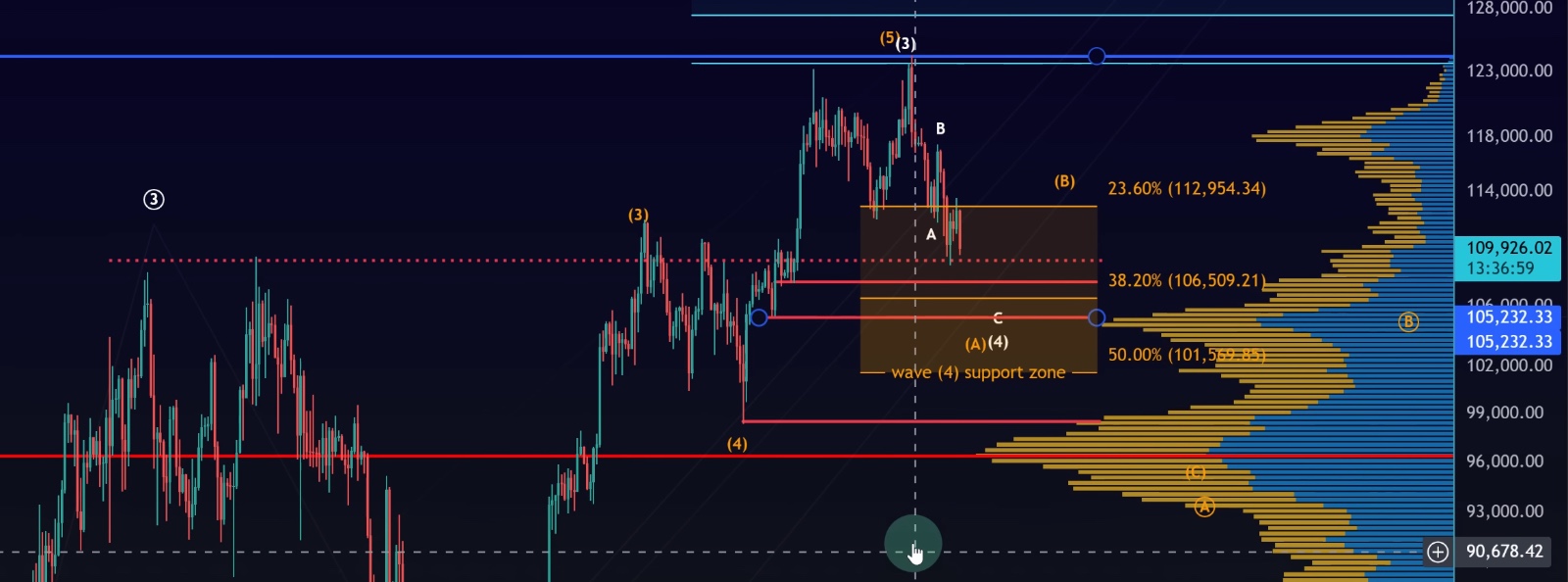

Key Support Levels

Bitcoin is holding above an important zone around $109,100, a level that has acted as support since the August 24–25 swing low (also linked to the “Trump inauguration speech” rejection level earlier this year). This dotted-line support remains the first key level to monitor.

Beyond this, several important support zones exist:

•$107,600 – $105,230 → Previous swing low zone.

•$106,510 → Aligns with the 38.2% Fibonacci retracement, a typical level tested during a Wave 4 correction.

•$105,000 → Broader support zone with historical reactions.

•$96,000 → Identified by the Volume Profile (VRVP) as a high-volume node, but we prefer not to see price fall this low unless weakness accelerates significantly.

If Bitcoin decisively breaks below the 78.6% retracement level, it would strongly suggest that a third wave decline is already in progress, pointing to a direct continuation of downside momentum.

Elliott Wave Outlook

•Scenario 1 – Wave 4: If this is a Wave 4 pullback, Bitcoin could still attempt a Wave 5 rally after support holds.

•Scenario 2 – Extended Correction: If the move down extends, Bitcoin could continue unfolding in a C-wave decline, with deeper supports tested before any recovery.

The critical signal to confirm a bullish scenario would be the development of a clear five-wave move up on the micro timeframes. Until then, all bounces remain suspect and corrective in nature.

Weekend Outlook

•Expect fragile bounces that may fall short of expectations.

•The market has already shown hesitation, with recent rallies missing projected extension targets by $300–$400.

•Risk remains elevated until a local bottom is confirmed.

Overall, Bitcoin still looks weak in the short term, and the correction is very likely to continue unfolding. The key question is whether support around $109,100 – $106,500 can hold to set up a broader bounce, or whether a deeper breakdown towards $105,000 and below will occur.

Conclusion

Bitcoin’s Elliott Wave structure shows that the correction is still in progress, and no decisive low has yet been confirmed.

•Immediate Support: $109,100

•Major Support Zone: $107,600 – $105,230

•Fibonacci Level: $106,510 (38.2% retracement, often tested in Wave 4 corrections)

•Deeper Risk Zone: $96,000 (per VRVP volume profile)

Until we see a strong five-wave rally from support, any bounce should be treated as corrective and fragile. Traders should avoid euphoric reactions to minor upward moves and continue tracking the micro-structure closely.