Bitcoin Daily Update: Navigating Resistance Amid September’s Choppy Market

Bitcoin has seen a modest uptick today, gaining around 6% on the daily timeframe. While not a major breakout, it’s notable progress in a month that’s historically been weak for crypto markets. Let’s break down the broader picture, the technical outlook, and what could be next for Bitcoin.

📊 Market Overview

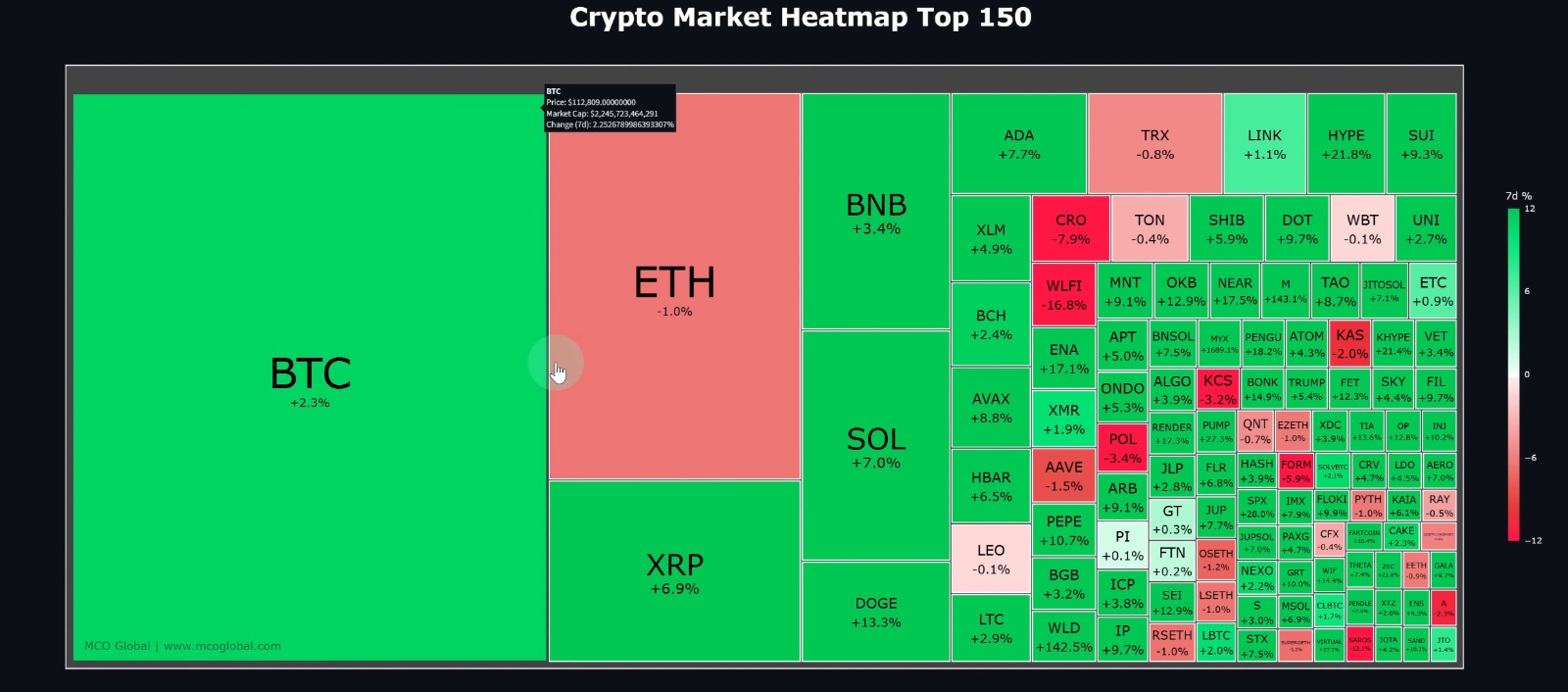

Looking at the sector heat map, Bitcoin’s performance is steady but not outstanding. Over the last 24 hours, several altcoins have outperformed BTC. For instance:

•XRP gained about 7%

•Solana also showed strong upside

•Ethereum, on the other hand, remained weak, stuck in a holding pattern with ETH dominance declining

Historically, September tends to be a bearish month for crypto, but so far, the first week has brought some green across the board. While that doesn’t guarantee continuation, it’s a welcome start.

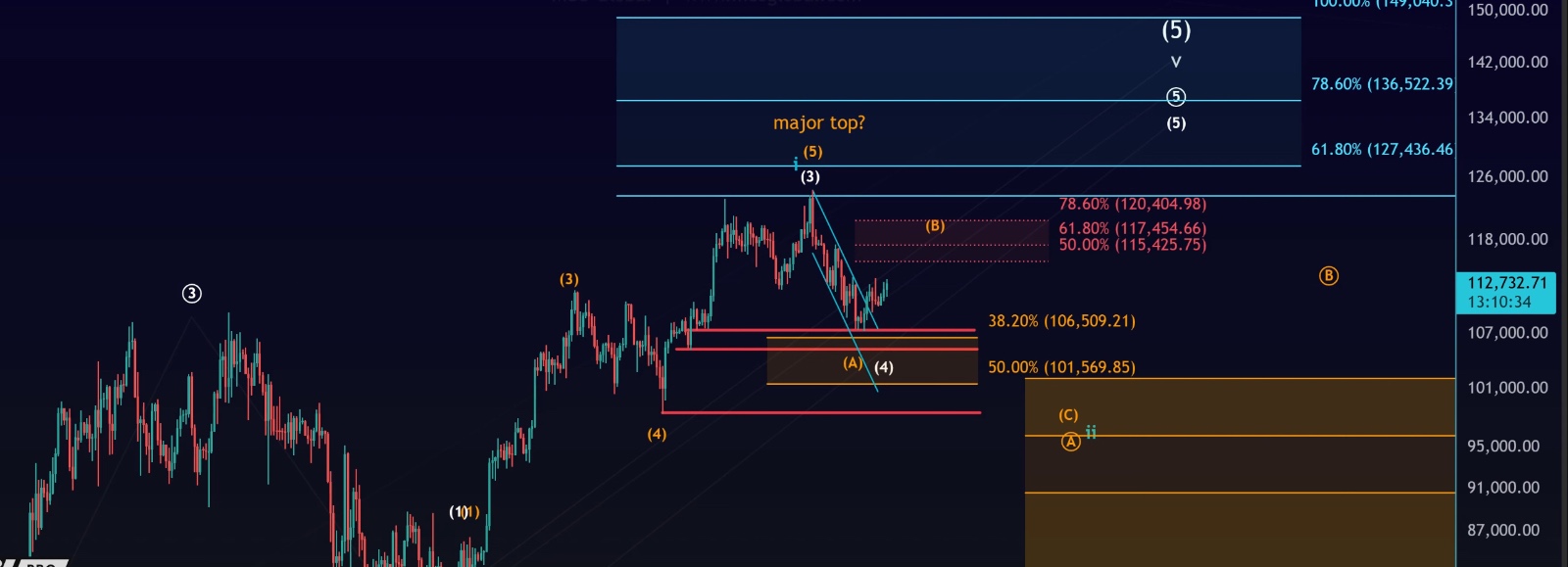

🔍 Bitcoin Daily Chart – Possible B-Wave in Play

From an Elliott Wave perspective, Bitcoin may currently be in a B-wave bounce. B-waves are typically corrective rallies, making them difficult to predict and often characterized by choppy, overlapping price action.

Key Resistance Zone

•$115,400 – $120,400 → Standard Fibonacci resistance area

•Strong historical volume interest around $118,000 (per VRVP indicator)

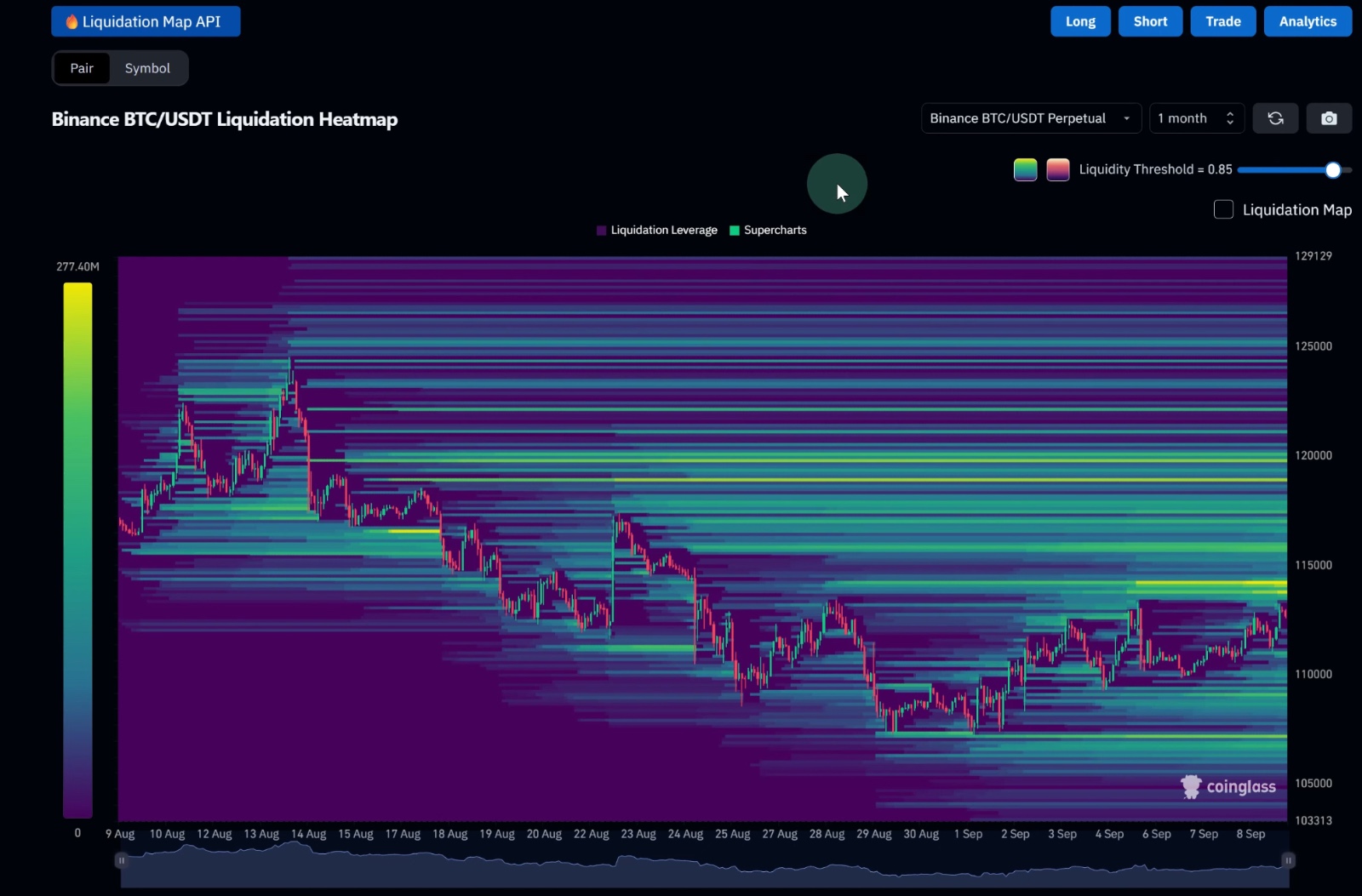

•Aligns with liquidation heatmap levels, suggesting this area could act as a magnet for price

This confluence makes the $115K–$120K range a critical battleground to watch.

📈 Short-Term Picture – Still Rangebound

Zooming into the smaller timeframes, Bitcoin remains stuck in a range, with no decisive breakout yet.

•Support levels are holding, keeping the pathway to higher prices intact

•Resistance zones are capping upside momentum

•Critical short-term resistance: $112,770

•A breakout above $113,530 would signal that bulls are regaining strength

Until then, the market is likely to remain frustrating and choppy—a hallmark of corrective B-waves.

⚡ Key Takeaways

1.September isn’t acting weak so far – Bitcoin is up modestly, and some altcoins are showing strength.

2.Bitcoin is testing resistance but remains rangebound – No clear breakout yet.

3.Watch $113,530 closely – A move above this level could trigger stronger upside momentum.

4.Big-picture resistance sits between $115K–$120K, where volume and liquidation levels cluster.

5.Patience is key – The Elliott Wave context suggests this rally is corrective, meaning volatility and chop should be expected.

✅ Bottom line: Bitcoin remains constructive, but without a clean breakout, the trend is still unclear. If BTC pushes through the $113,530 level, the probability of testing the $115K–$120K zone increases significantly. Until then, traders should remain cautious and avoid blindly chasing price moves.