Cycle Perspective: Q4 Is the Window to Watch

The Bitcoin chart is holding above support, and since the market hasn’t made any major moves over the past day, today’s update will focus more on the cycle perspective. This gives us a broader context for where Bitcoin stands while also touching on shorter-term setups.

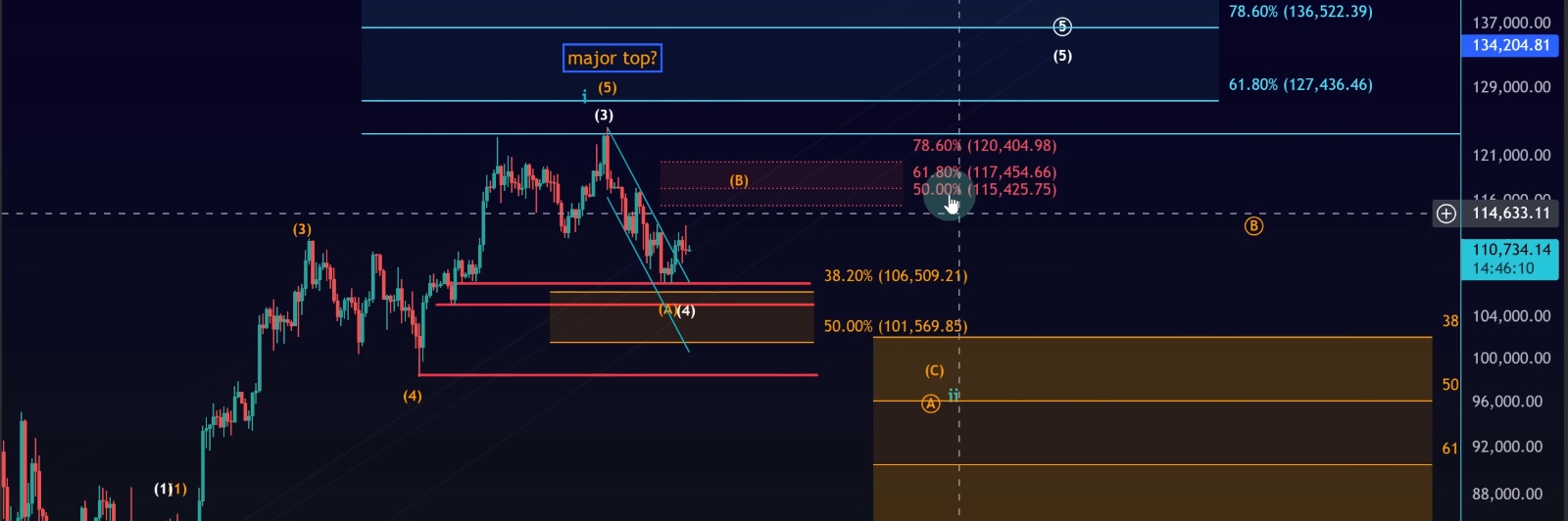

No Confirmed Major Top

Despite recent pullbacks and red candles, there is still no confirmed major top in Bitcoin.

•Yes, one Elliott Wave count suggests that the five-wave sequence from the 2022 low to the August 2025 all-time high could be complete.

•But a completed wave count only signals caution—it does not automatically mean a reversal is underway.

•In fact, topping here at $124K–$125K would make this cycle unusually short compared to past cycles.

For now, Elliott Wave still presents two bullish pathways, which keeps the focus on higher prices.

Cycle Perspective: Q4 Is the Window to Watch

Looking at Bitcoin’s historical cycle lengths:

•2015 low → Dec 2017 high: ~1,060 days

•Dec 2018 low → Oct 2021 high: ~1,060 days

•Current cycle (2022 low → present): ~1,034 days so far

This suggests Bitcoin is nearing the time window for a cycle top, but not necessarily there yet.

Key points:

•Historically, Bitcoin has not topped in October.

•2021’s peak came in early November, while the 2017 cycle extended slightly longer.

•This cycle feels more muted compared to prior blow-off tops, which could mean a longer extension into late Q4.

Bottom line: Q4 remains the window to watch—October, November, or possibly even December.

September Weakness, But Lows Can Form

•Historically, September is one of Bitcoin’s weakest months (e.g., -8% in 2017, -7% in 2021).

•However, lows have often formed in September:

•September 2021 marked a significant swing low before the October–November rally.

•2023 also saw sideways grinding into September before resuming higher.

So while September tends to be “red,” it can also set the stage for a stronger Q4 recovery.

Short-Term Technical Picture

Even though the cycle view dominates today’s outlook, the shorter time frames still matter:

•A B-wave bounce may be unfolding.

•If so, Bitcoin could push into the $117,500–$118,000 zone.

•This area has heavy liquidity clusters (per heat maps).

•VRVP shows a Point of Control at $118K, which often acts like a price magnet.

•Short-term support zone: $108,550–$110,270

•Short-term bullish trigger: Break above $113,550 → increases probability of rallying to $118K.

For now, price is consolidating sideways.

Conclusion

•No confirmed top yet → focus remains on higher prices.

•The cycle perspective suggests Q4 is the key time window for a potential peak, though this cycle may extend longer than prior ones.

•September is historically weak but often marks swing lows.

•In the short term, Bitcoin’s roadmap could point toward $118K in a corrective B-wave rally—watch for confirmation above $113,550.

As long as Bitcoin holds above support, the structure remains intact. The coming weeks could be pivotal, as cycle timing and technical levels begin to align.