Bitcoin Daily Update: Holding Above the Channel, But Market Still Vulnerable

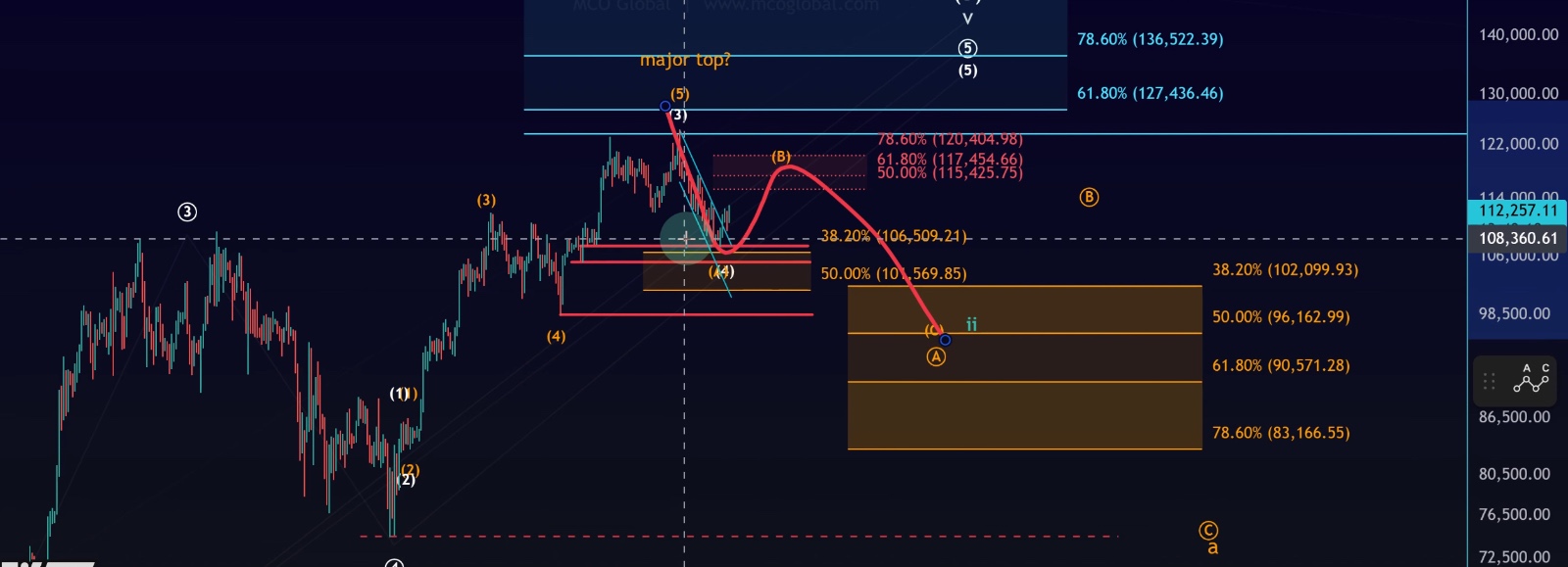

On the daily time frame, Bitcoin continues to trade slightly above the former price channel. While this is encouraging, there is still no meaningful confirmation of a major top or the start of a bear market. Instead, the structure remains highly vulnerable, with two possible bullish pathways still in play—but also the risk of a broader correction.

No Bear Market Confirmation Yet

• Despite warnings from Elliott Wave analysis, there is currently no clear indicator confirming a bear market has begun.

• The completed five-wave structure from the 2022 low to the recent all-time high does warrant caution, but a completed wave count does not automatically guarantee reversal.

• On-chain data continues to show no signs of an overheated market, supporting the case for more upside potential.

Possible Broader Correction

One risk is the development of a larger wave two correction (ABC structure).

• In this case, the current bounce could be a B-wave rally rather than the start of a fifth wave to new highs.

• The next major resistance block sits between $115,400 and $120,400, with confluence from:

• VRVP Point of Control around $118,000.

• Liquidity clusters highlighted on liquidation heat maps.

• This zone could act as a magnet for price, but it is also where a rejection could occur if the move is corrective.

Shorter Time Frame Analysis

• Bitcoin reacted strongly to Fibonacci support discussed in yesterday’s update.

• The pullback formed a three-wave structure into support, keeping the short-term uptrend intact.

• From there, price has been moving in a choppy sideways range between $108,000 and $112,000, making trading each wave difficult.

Key Levels to Watch

• Green Signal Line (113,520):

• A break above would invalidate the bearish 1–2 setup and increase the probability of a push into the $115K–$120K resistance zone.

• Yesterday’s Low (around $109,800):

• A break below could open the path toward $106,500–$105,250, possibly even $100K in an extended correction.

Structure Remains Vulnerable

• So far, both support and resistance levels have held well.

• But the market remains squeezed between decision points:

• Support: $107,400–$109,800

• Resistance: $111,000–$113,500

• The longer Bitcoin consolidates below resistance, the higher the chance of a breakout to the upside. Yet, traders must remain alert—because even a strong move higher could still be just a B-wave bounce.

Conclusion

Bitcoin’s structure remains at a crossroads:

• Above $113,520 → opens the path toward $118K–$120K.

• Below $109,800 → raises the risk of a deeper pullback toward $105K–$106.5K, or even $100K.

For now, Bitcoin continues to move from support to resistance, holding levels but not yet providing clarity. The market has not revealed its hand, so patience and caution remain critical.