Bitcoin Daily Update: Resistance Reaction and Selloff in Play

Bitcoin, along with several other major altcoins, is currently experiencing a selloff. This move, however, was not unexpected. Charts such as Solana and ADA had already been primed for corrections, and Bitcoin itself has now begun to react within our predefined resistance area.

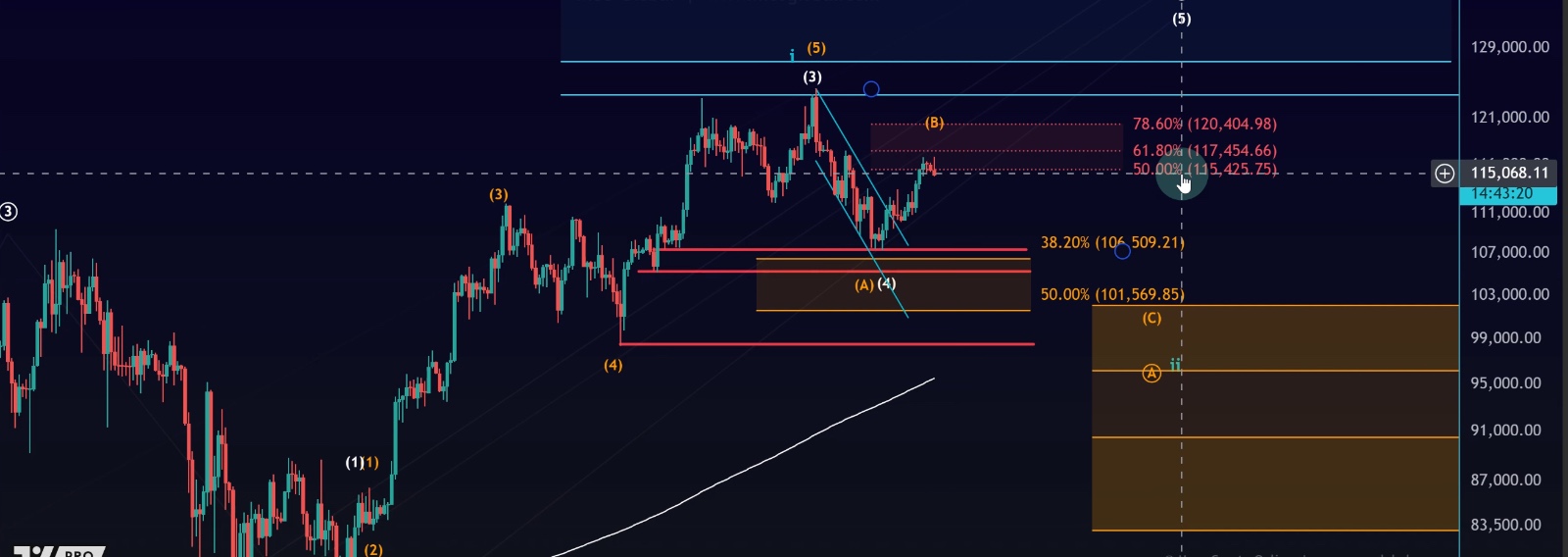

📊 Daily Chart – Resistance Playing Out

As highlighted over the past weeks, Bitcoin has entered a Fibonacci resistance zone between $115,420 and $120,400. This region was always expected to cause turbulence, and the current pullback confirms that resistance is doing its job.

•Reaction is normal: A bit of red in this zone is not a surprise. Resistance exists for a reason.

•B-wave risk: If the B-wave has already topped, the C-wave could begin, targeting lower support zones.

•Key downside levels: A deeper C-wave decline could reach into the $102,000 area, with $96,000 marked as a particularly strong support region.

At this stage, however, it’s too early to confirm that the B-wave is over.

📈 Short-Term Chart – Wave Count Completed

On the intraday chart, Bitcoin has now technically completed its C-wave structure from the September low:

•Until yesterday → we only had three waves up in the C-wave.

•Overnight push → completed the fifth wave, giving us a full five-wave count.

•Current issue → the fifth wave looks weak, suggesting momentum may be fading.

What This Means

•A full wave count does not guarantee a top but raises the probability.

•A strong rejection from both resistance and the blue target zone adds weight to the idea that a top may be forming.

•However, support is still intact, so further upside remains possible.

🔑 Support and Confirmation Levels

•Key support: $113,490 → this remains the critical level to watch.

•As long as Bitcoin holds this support, another push higher is still possible.

•If price breaks below $113,490 decisively, the probability increases that the B-wave has topped.

For confirmation of a top:

•We need to see a five-wave move down.

•Without that, current moves remain range-bound noise.

⚠️ Avoid the Noise

Markets are currently ranging between resistance and support. In these conditions:

•Every small uptick is often misread as a new rally.

•Every downtick is labeled as the end of the world.

•This is how traders get chopped up in consolidation.

👉 Important reminder: consolidation is not a trend. It’s preparation for one. The task now is to separate signal from noise and wait for decisive moves.

📌 Final Takeaways

1.Bitcoin has entered our resistance zone ($115.4K–$120.4K) and is reacting as expected.

2.A complete C-wave structure is now in place, but the top is not yet confirmed.

3.Support at $113,490 is the line in the sand. As long as it holds, further upside remains possible.

4.A decisive break of support + five-wave decline would confirm the start of a C-wave down.

5.For now, price remains range-bound noise within support and resistance.

✅ Bottom line: Bitcoin is at a critical junction. While a top may be forming, confirmation is still missing. Until support breaks, the door for one more push higher remains open.