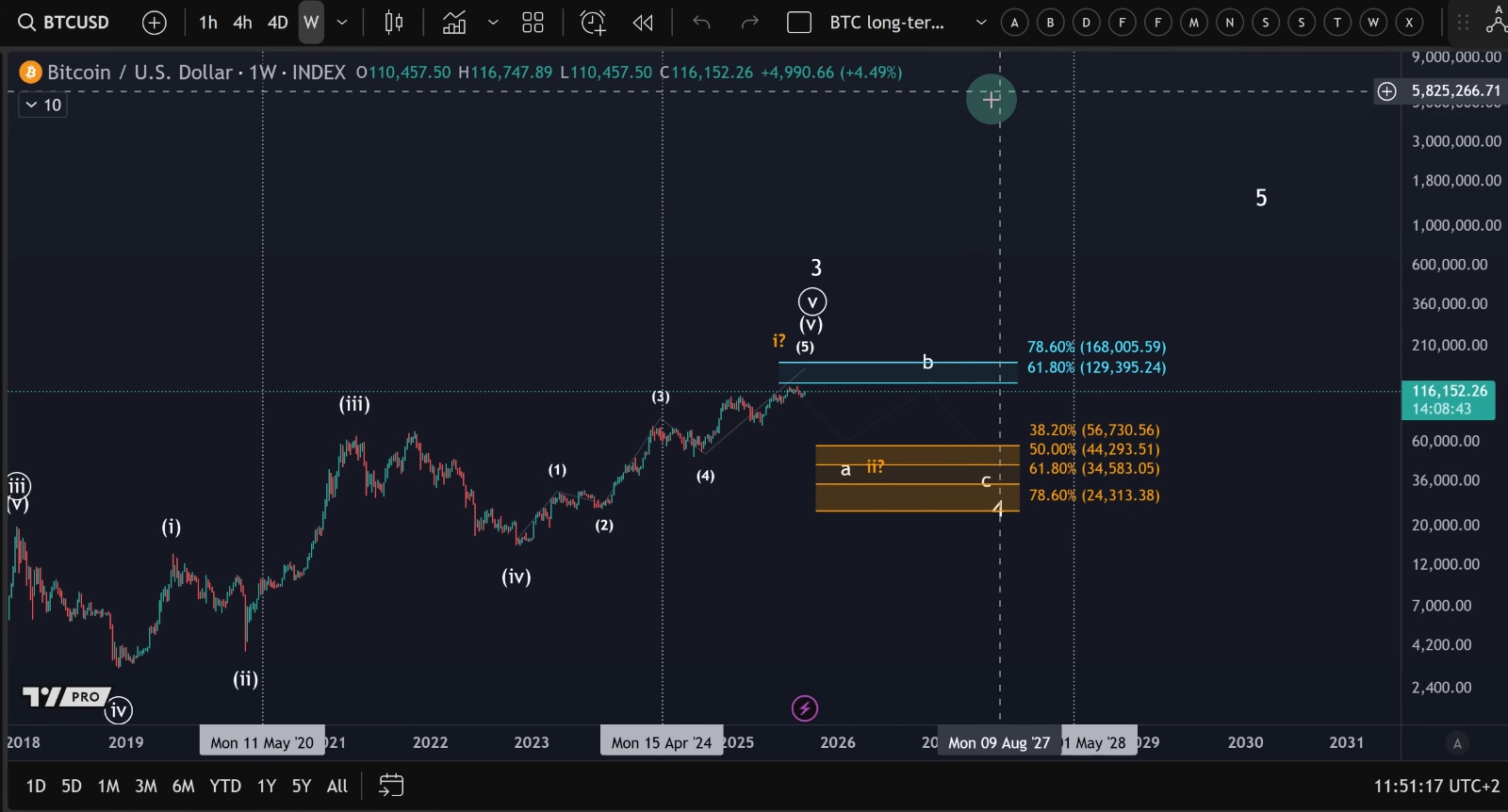

Bitcoin Price Analysis: Resistance Test, Fed Rate Decision Ahead, and Q4 Outlook

Bitcoin is approaching a critical resistance level as the market prepares for the upcoming Federal Reserve interest rate decision. While risks of a major top are increasing, historical trends and Elliott Wave analysis suggest that Q4 2025 could still deliver profitable opportunities for traders and investors.

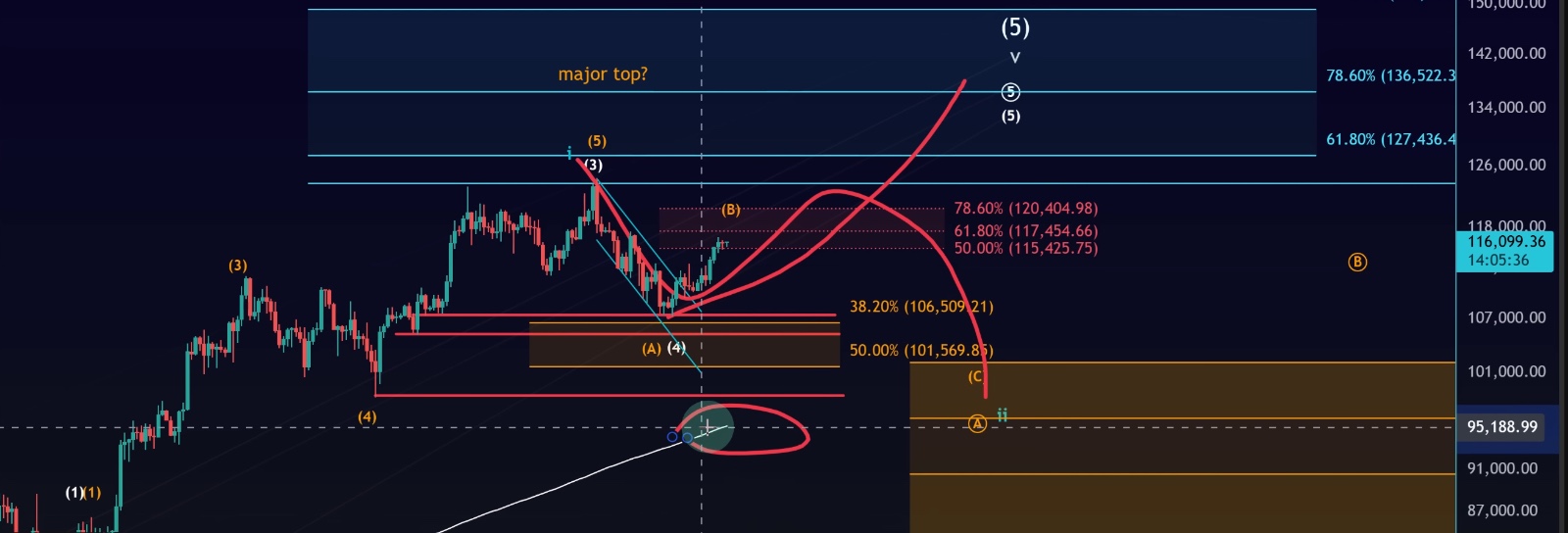

📊 Daily Chart: Resistance Zone in Focus

Bitcoin is currently testing a key resistance area around $117,454. This level is particularly important in the context of the B-wave structure we’ve been tracking.

•Key resistance levels: $117,454 → $120,400

•Support corridor to watch: $95K region (if a broader correction unfolds)

•Indicators in play: 55-week EMA and 1-year SMA as dynamic support levels

It’s worth noting that B-waves don’t always respect Fibonacci levels. If Bitcoin pushes decisively above this resistance without rejection, it could suggest we’re already in a move toward a new all-time high.

At the same time, the macro risk is high. Multiple Elliott Wave counts allow for the possibility that a major five-wave structure is complete. Still, probabilities currently lean toward at least one more push higher before a confirmed top.

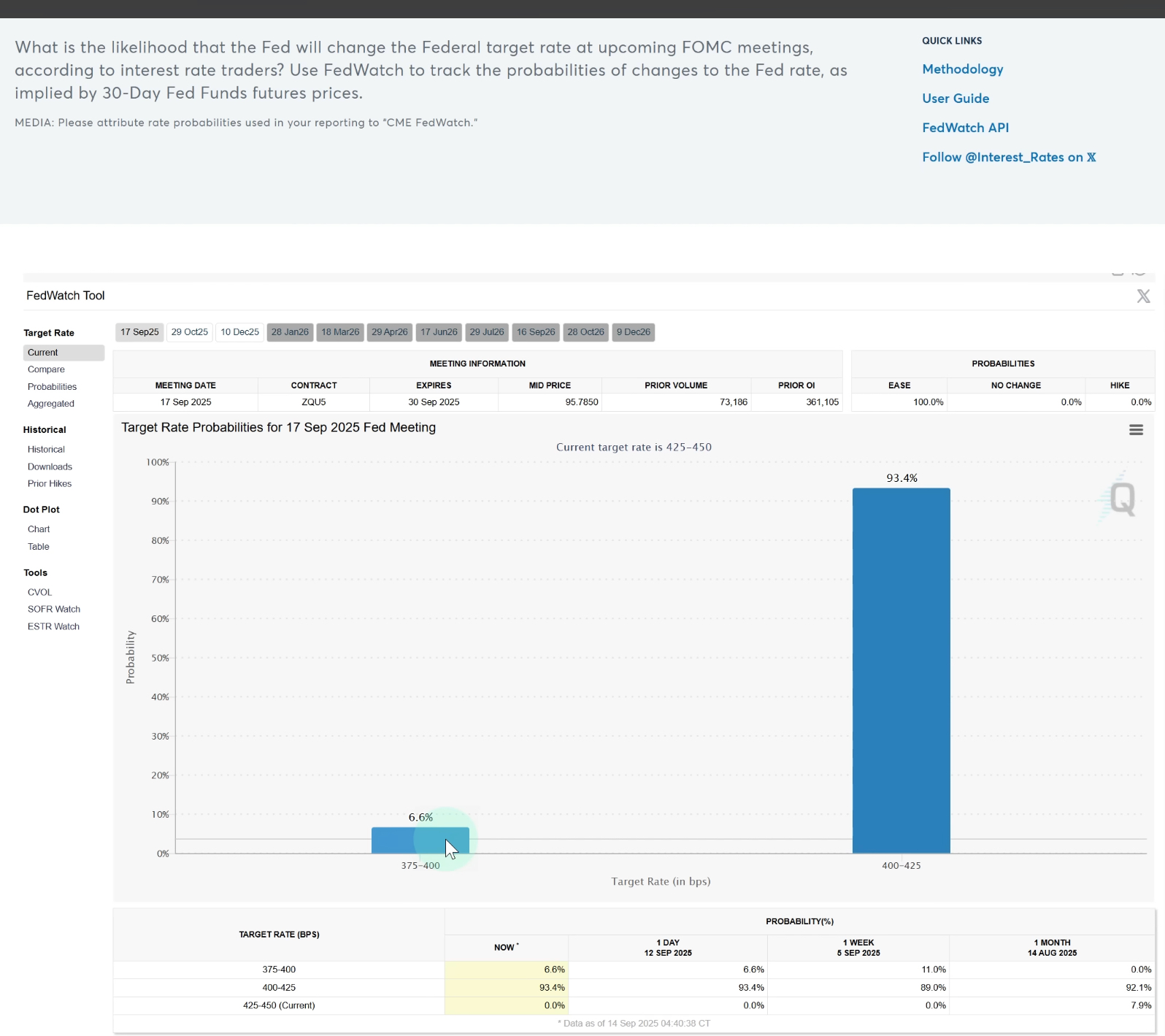

🏦 Fed Interest Rate Decision: Why It Matters

The next FOMC meeting is just three days away, and markets are closely watching the outcome. Current probabilities suggest:

•93.4% chance of a 25 basis point rate cut

•6.6% chance of a 50 basis point cut

While a 25bps reduction is largely priced in, a surprise 50bps cut could spark short-term upside across risk assets, including Bitcoin.

Historically, Bitcoin has rallied both during rate hikes and rate cuts, defying the mainstream narrative. For example:

•Between 2015 and 2017, interest rates rose steadily from near zero to 1.5% — and Bitcoin surged.

•In late 2022 to early 2023, rates climbed again, but Elliott Wave analysis correctly pointed to a bull market.

👉 Key takeaway: while rate cuts can fuel short-term sentiment, they don’t guarantee a long-term bullish trend. Traders should remain cautious and rely on structure and support levels, not narratives alone.

📈 Short-Term Outlook: Higher Prices Still Possible

On the shorter time frame, Bitcoin spent the weekend consolidating sideways. Support levels remain unchanged:

•Immediate support zone: $113,500 – $115,000

•Critical level: break below $113,500 = likely B-wave top

•Upside targets: $117,660 → $118,500

If the price holds above support, we could still see at least one more high. A dip into the $113.5K–$115K support range would likely just confirm an extended wave four before another push upward.

🔮 Q4 Outlook: Seasonal Strength and Risks

•Historically, Bitcoin has never topped in October, making Q4 a strong seasonal period.

•With multiple rate cuts expected before year-end, liquidity conditions may improve, supporting high-risk assets.

•Still, traders must remain cautious: the macro top risk remains elevated, and any rejection near $118K–$120K could trigger deeper corrections.

⚡ Key Takeaways

1.Bitcoin is at a critical resistance zone near $117,454–$120,400.

2.The upcoming Fed decision could act as a catalyst, but the effect may be short-term.

3.Support at $113.5K–$115K remains crucial for the bullish case.

4.Both Elliott Wave scenarios (final wave up vs. corrective B-wave) remain valid.

5.Q4 seasonality and expected rate cuts suggest potential for further gains — but a larger top could form at any point.

✅ Bottom line: Bitcoin is walking a fine line. Short-term momentum still points higher, but resistance and macro risks demand caution. Whether this is the final leg of a B-wave correction or the start of a powerful wave five rally, the next few days — especially the Fed decision — will be pivotal.