Today, let’s start with the bigger seasonal picture before zooming in on Bitcoin’s price action.

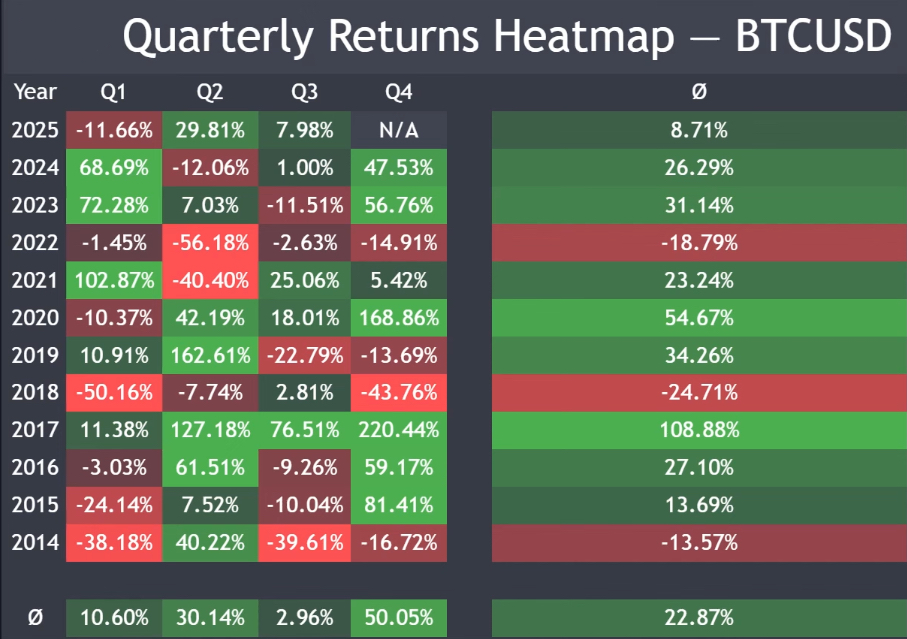

Q4: Bitcoin’s Strongest Quarter 4

Historically, Q4 has been Bitcoin’s best-performing quarter:

• 2024: +47.5%

• 2023: +56.7%

• 2022: Negative (bear market year) but marked the start of BTC’s recovery.

• 2021: Positive but cycle topped in November.

The pattern is clear: October, November, and December usually bring strong performance, with Q4 often being the turning point in cycles.

📌 Key takeaway: Don’t sleep on Q4. Whether it delivers another rally or marks a cycle top, this quarter is always critical for Bitcoin.

What About 2025?

• We’re in a post-halving year, just like 2021.

• That means Q4 could again be decisive — either driving strong gains or producing a major top.

• Probability favors volatility and opportunity. Even if September has been weak (as usual), Q4 is where market action really accelerates.

This also applies to altcoins. A strong Bitcoin in Q4 can spark broader moves across Ethereum, BNB, and the altcoin market.

Market Signals Beyond BTC

• USDT Dominance: Currently moving sideways. A decline in USDT dominance is bullish for crypto overall, as it signals funds rotating into BTC and altcoins.

• BNB Example: Despite low retail interest, BNB has already hit key targets this cycle and has been one of the better performers. This shows how rotation flows matter, especially in Q4.

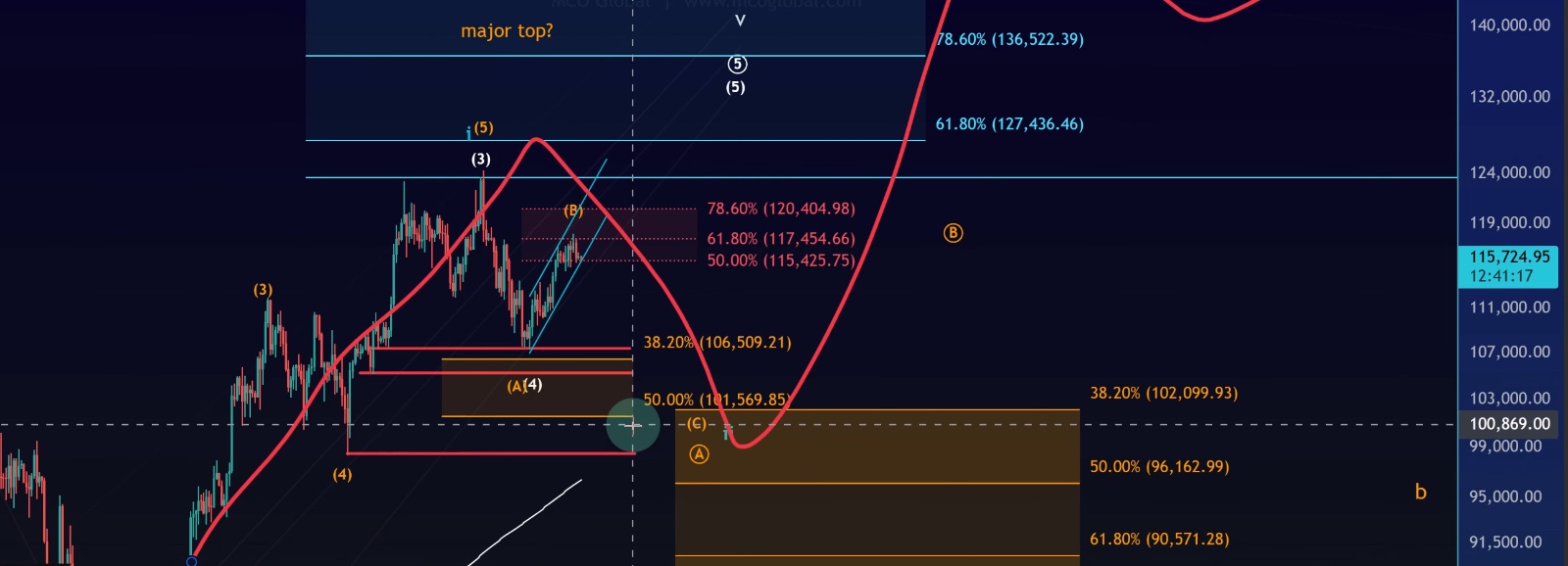

Bitcoin’s Short-Term Technical Picture

On the daily chart:

• BTC has reached the 118K resistance area highlighted by Fibonacci and VRVP.

• Price is now consolidating, moving sideways in a channel.

• Channels always break eventually, so we’re watching whether it breaks upward into new highs or downward into a broader correction.

On the shorter time frame:

• BTC broke the channel sideways over the weekend, but that move lacks volume, so it’s not meaningful yet.

• The critical support zone remains $113,580 – $115,820.

• This aligns with both Fibonacci support and structural swing highs.

• Holding above this support keeps the bullish wave 5 scenario alive.

If BTC fails to hold, we could still track an alternative 1–2 setup before another push higher. But for now, the focus is on whether BTC can produce five clean waves up — the confirmation needed for the bullish case.

Key Levels to Watch

• Support:

• $115,820 – $113,580 (immediate zone)

• Resistance:

• $118K (Fibonacci and structural resistance)

• Macro Warning Level:

• $95K (55-week EMA & 1-year MA — a decisive break would be a major red flag)

Final Thoughts

• Seasonality: Q4 is historically Bitcoin’s strongest quarter — and also where major cycle tops have occurred.

• Current Structure: BTC is holding key support; a break above resistance would strengthen the bullish case.

• Risks: A decisive move below $95K would shift the narrative toward a multi-year correction.

For now, Bitcoin is at a decision point: holding support keeps the bullish roadmap alive, but volatility is likely into today’s weekly candle close.

👉 The message is simple: don’t underestimate Q4. Historically, it’s where the real action begins.