The market is moving slowly heading into the weekend, but that also gives us the opportunity to look beyond short-term Bitcoin price action and dive into broader market dynamics—especially Bitcoin dominance and what it means for altcoin season.

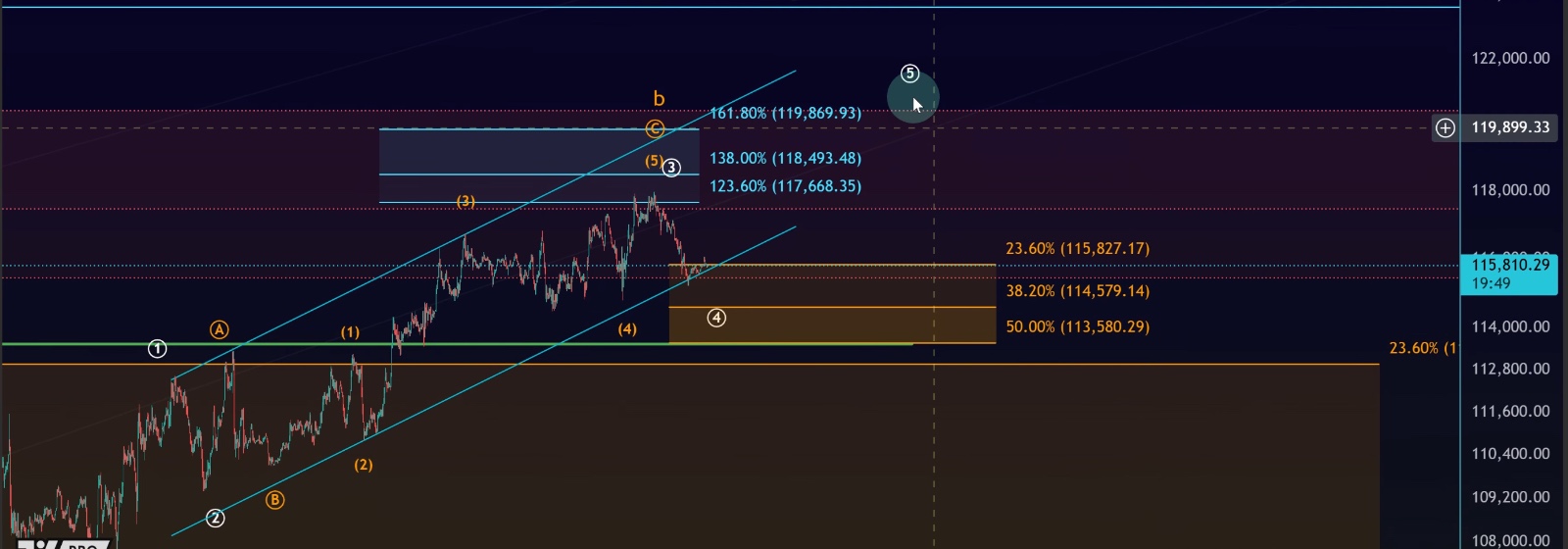

Bitcoin Price – Testing Resistance

On the daily chart, Bitcoin is still trading within its ascending price channel. We are currently testing the lower boundary of that channel, and so far, there has been no decisive breakdown.

•Key resistance: The area around the 61.8% Fibonacci retracement (~$117,450).

•Next resistance: If Bitcoin can push above this level, the door opens to $120,400.

•Key support: Short-term structure remains intact as long as the market holds above $113,580 – $115,827, which also aligns with previous swing highs.

This resistance area is a decision zone. A rejection here could confirm a B-wave top, while a breakout above could support further upside. For now, sellers are active at resistance, but they have not taken control yet.

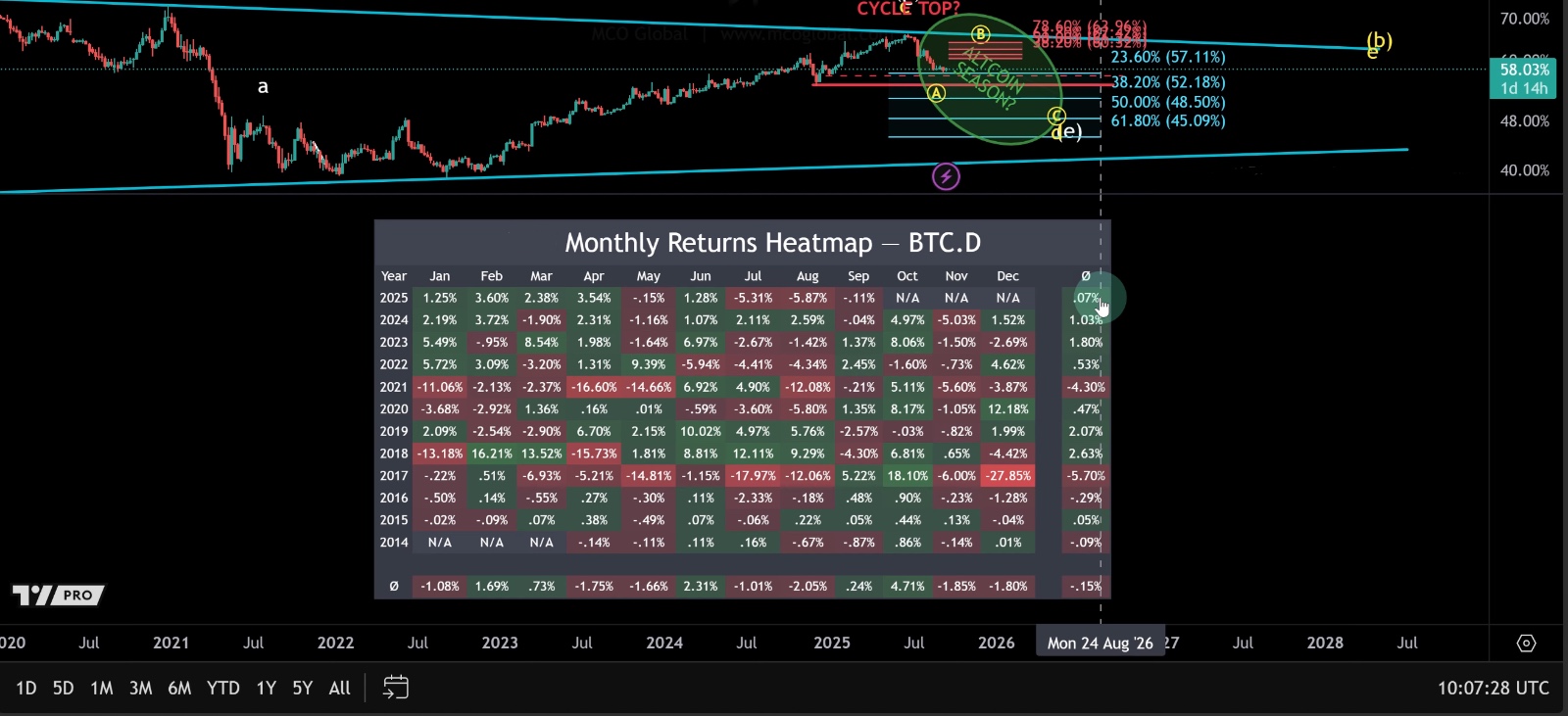

Bitcoin Dominance – Altcoin Season or Not?

Many traders are watching Bitcoin dominance (BTC.D) to gauge whether an altcoin season is coming. Since the June high, dominance has fallen sharply, similar to past cycles. But does that automatically mean altcoin season? Not necessarily.

•Why not “altcoin season”?

•The popular “altcoin season indicator” is misleading—it’s a lagging metric, only looking back at the last 90 days.

•Instead of all altcoins rising, performance has been selective, with Ethereum and a few groups of coins leading.

•Ethereum’s role: Ethereum dominance has been climbing, which means ETH has been a key driver of the decline in Bitcoin dominance—not a broad altcoin rally.

•Seasonality effect: Historically, October has been the strongest month for Bitcoin dominance, while November tends to be the weakest.

•This suggests Bitcoin may regain strength in October before potentially setting the stage for stronger altcoin performance in November.

In short: Don’t expect a “full-blown” altcoin season. Instead, expect selective moves in specific projects, while Bitcoin may take the lead again in October.

Short-Term Bitcoin Outlook

Zooming in, the immediate focus is on the $113,580 – $115,827 support zone. This level has held as strong structural support, reinforced by both Fibonacci retracement and past price action.

•If support holds, Bitcoin could still push higher within the bullish scenario (five-wave rally from the September low).

•A decisive break below support, however, would signal a local top and shift momentum back to the bears.

For now, the trend remains intact, with no impulsive sell-off visible.

Key Levels to Watch

•Support: $115,827 – $113,580

•Resistance: $117,450 (61.8% retracement), $120,400

•Dominance trend: Possible October rebound before altcoins gain strength again in November

Final Thoughts

The market remains at a decision point. Bitcoin is holding support within its channel, but sellers are testing resistance. Meanwhile, Bitcoin dominance data suggests that October could favor BTC before a possible rotation back into altcoins later in the year.

Stay cautious around resistance and keep an eye on dominance shifts—they may be the key driver of altcoin opportunities over the coming months.