Bitcoin Daily Analysis: Q3 Frustration, Q4 Optimism

The Bitcoin market continues to hold its ground above key support levels, with no significant breakdown in sight. While short-term action remains sideways and frustrating, the bigger picture offers reasons for optimism—especially as we head into Q4, historically one of Bitcoin’s strongest quarters.

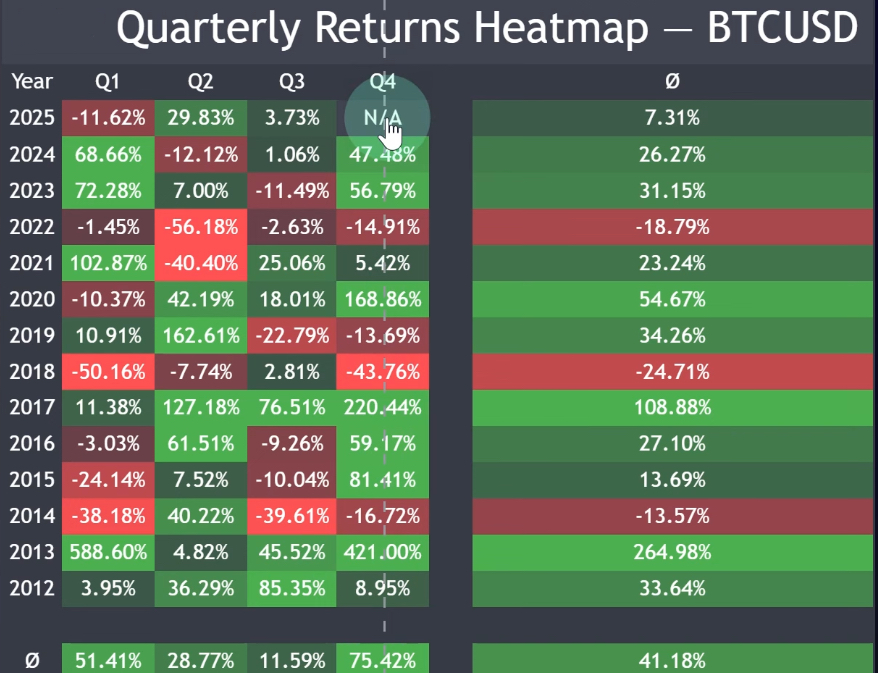

Quarterly Returns: Why Q4 Matters

Looking at Bitcoin’s historical quarterly returns:

• Q3 is usually weaker and underwhelming, though still positive on average.

• Q4, however, consistently stands out as the strongest quarter.

• Even in cycle top years—such as 2017 and 2021—Bitcoin delivered strong Q4 performance before peaking.

With 2025 being a potential cycle top year, Q4 remains the window to watch. While history doesn’t guarantee the same outcome, ignoring Q4 could mean missing one of the most important phases of this cycle.

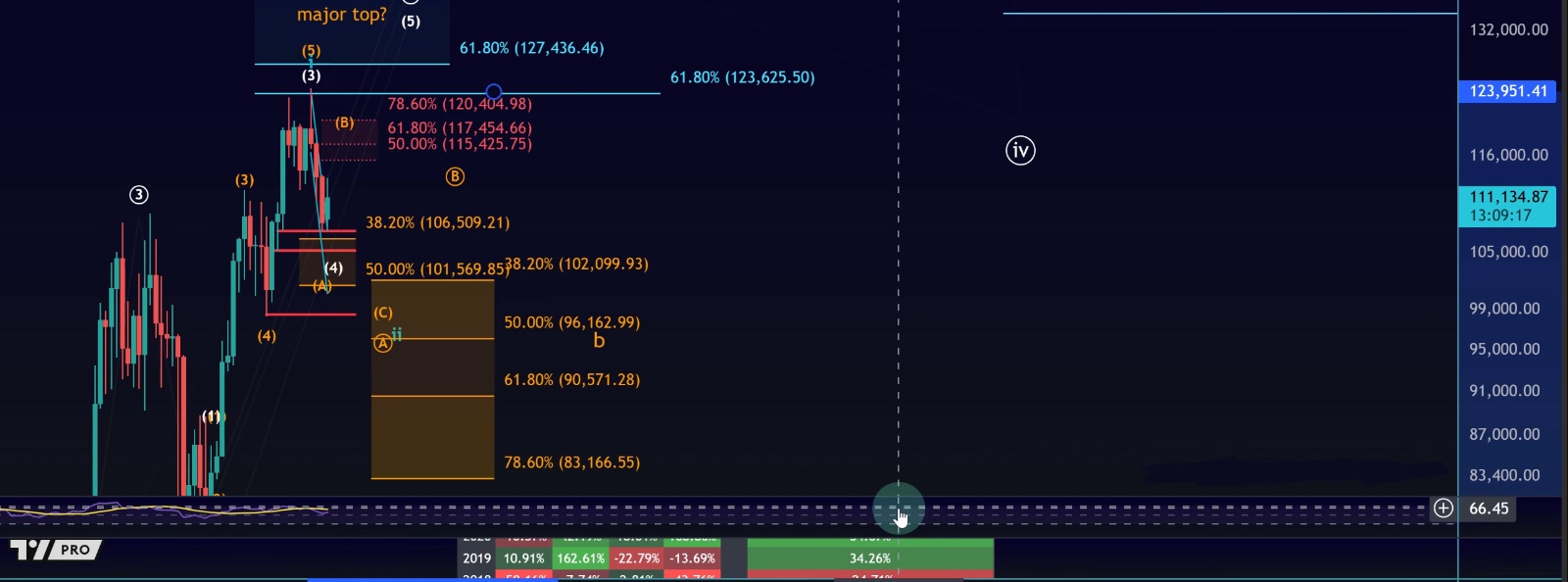

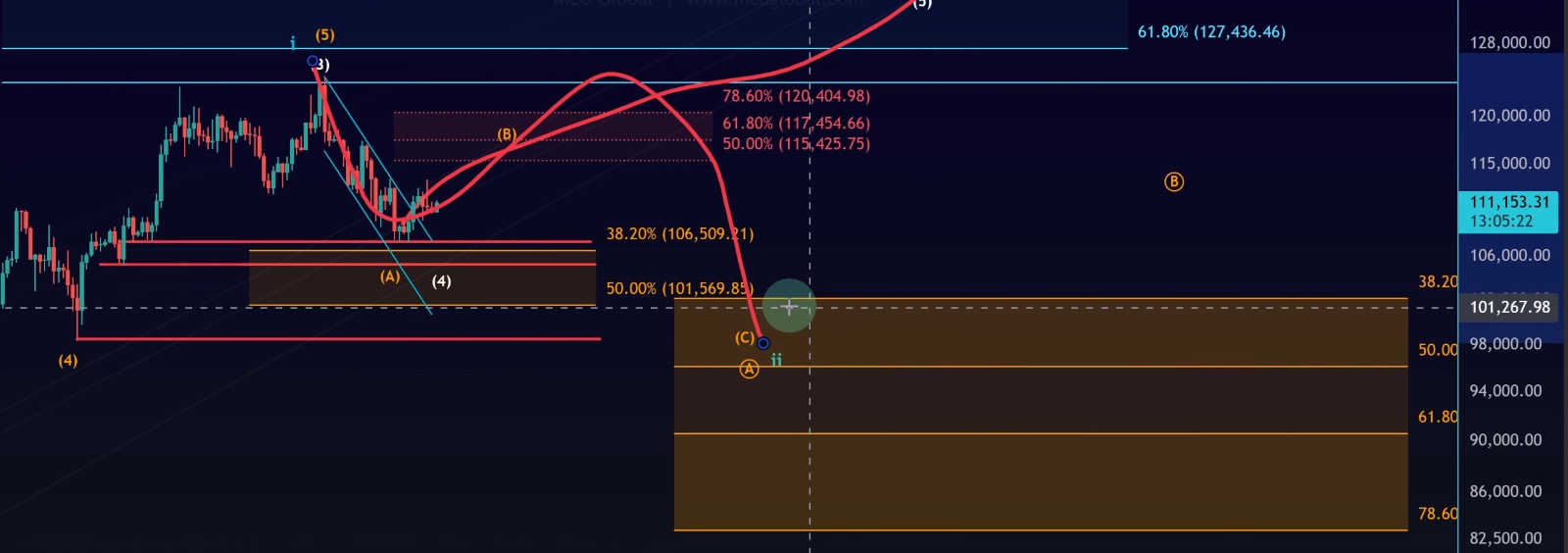

Elliott Wave Perspective: Still Bullish

From an Elliott Wave point of view:

• The recent move down could be counted as an A-wave decline.

• A B-wave bounce may now be unfolding, potentially targeting the $115,425 – $120,450 zone.

• Afterward, a C-wave down could follow before the next major leg higher.

It’s worth noting that B-waves are unpredictable—they often don’t align perfectly with Fibonacci levels and can appear “chameleon-like” in structure.

Despite this, the overall Elliott Wave model continues to present two bullish pathways:

1. A direct route higher toward $130K+

2. A longer corrective path before resuming higher

The only bearish alternative is one speculative wave count that allows for a major top already being in place—but this remains unsupported by evidence.

Support Holding, Resistance Still Intact

Support Holding, Resistance Still Intact

On the chart:

• Bitcoin continues to respect previous swing lows (from June and July).

• Price broke out of a downward channel earlier this week, retested it successfully, and is now moving sideways—a classic B-wave signature.

• Support zone for the weekend: $108,550 – $110,270

• First breakout trigger: $113,527 (exchange-dependent)

• If this level breaks, Bitcoin could rally into the red resistance zone ($115K–$120K).

For now, however, price is simply ranging sideways, offering little new information.

Short-Term vs. Long-Term Outlook

• In the short term, the market remains choppy, with no confirmed breakout yet. Weekend ranges may persist until weekly volatility picks up at the candle close.

• In the longer term, the cycle outlook remains bullish, with Q4 being the crucial window for potential continuation or even a cycle peak.

Conclusion

Bitcoin is holding steady above key supports while preparing for its next major move. The market is range-bound for now, but the probabilities of an upside breakout are increasing as support continues to hold and resistance is tested.

Historically, Q4 has delivered some of Bitcoin’s best returns, even in cycle top years. While no guarantees exist, this upcoming quarter should not be ignored.

As long as no critical supports are broken, the Elliott Wave model and broader cycle analysis suggest further upside remains the base case.