Bitcoin Daily Analysis: Bullish Pathways Still Intact

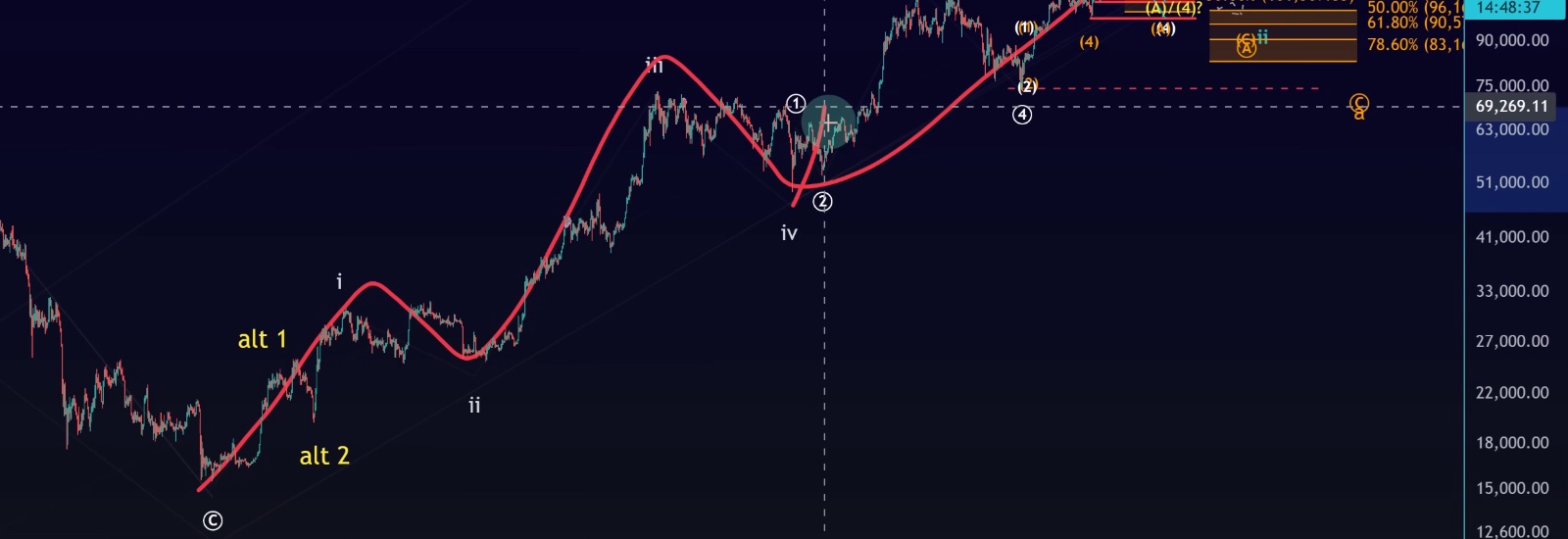

Bitcoin remains in a pivotal zone on the daily chart. Despite recent pullbacks, the bullish perspective has not changed. There are still two potential pathways for Bitcoin to move towards new all-time highs. Let’s break down the scenarios, key support and resistance zones, and what to watch in the coming days.

Two Bullish Pathways

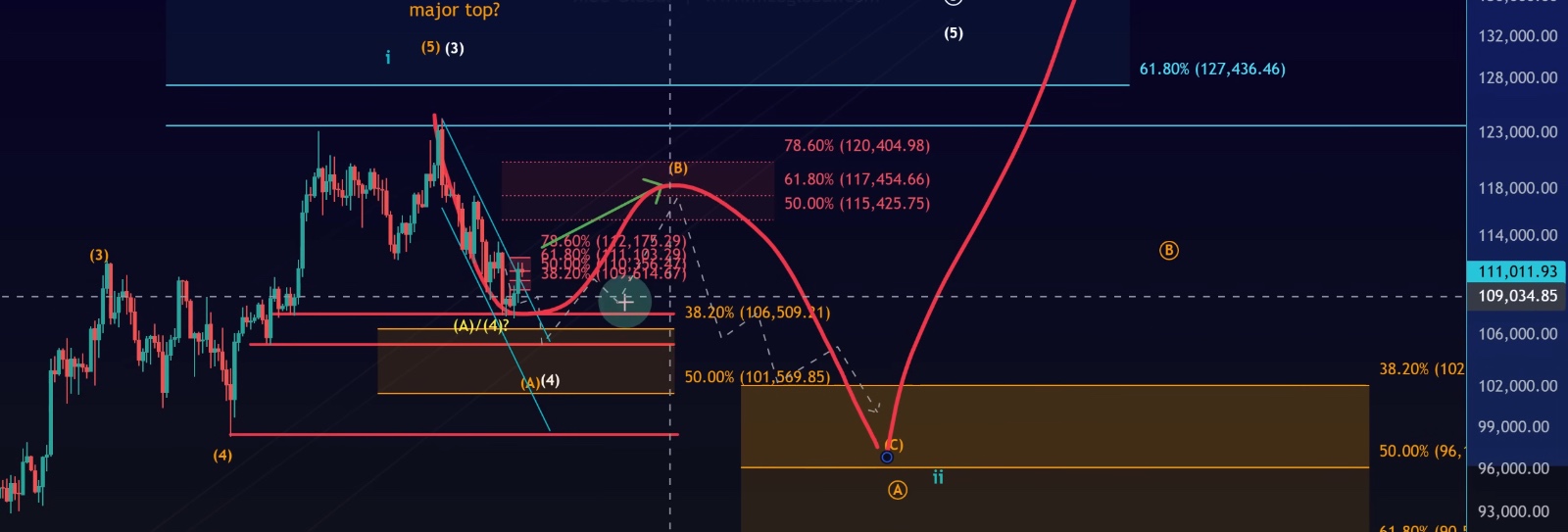

1.Wave Four Scenario (Green Channel)

•The current pullback may represent a wave four formation.

•If this holds, a five-wave rally could emerge from the recent lows.

•This would set the stage for a fifth wave to the upside, potentially taking Bitcoin above $130,000.

•Confirmation requires a clear five-wave move up and a break above Fibonacci resistance.

2.Larger Corrective Pullback

•If the current rally turns out to be corrective, a deeper pullback could unfold.

•Bitcoin may revisit the $96K–$90K zone before setting the stage for another powerful move higher.

•This would align with a wave two base before a strong wave three rally.

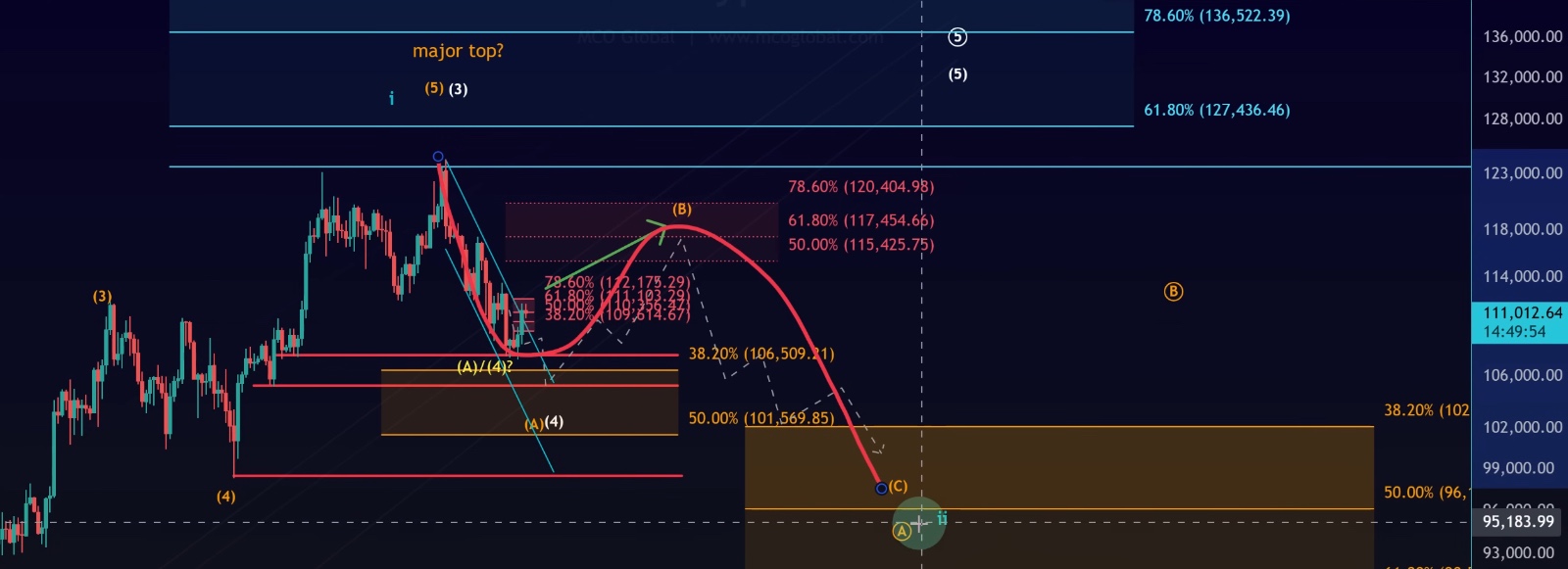

Key Support Zones

•$101,569 – $106,510 → Strong support area that could fuel the next rally.

•If price falls further, $96K–$90K remains a potential bullish launchpad.

Resistance Levels to Watch

•$109,600 – $112,000 → First critical resistance.

•$115K – $120K → Major liquidity zone with heavy order books and volume cluster.

•Point of Control (PoC) sits at $118,200, a key level where price may slow down.

Current Price Action

•Bitcoin has broken above the trend channel’s upper boundary, which is encouraging.

•However, price is still consolidating below micro Fibonacci resistance ($111,120–$112,170).

•No clear topping signal yet → Market looks more like sideways consolidation than reversal.

If price breaks above resistance, we could see a fast rally higher. Conversely:

•A break below $109,290 signals wave 2 (orange) may have topped.

•Further confirmation comes with a move below $107,300.

Seasonal & Historical Perspective

•September has historically been Bitcoin’s worst-performing month.

•Q4 (October–December) tends to be the strongest quarter on average.

•This suggests that if weakness persists in September, a larger recovery in Q4 remains likely.

Conclusion

The bullish structure remains intact. Two key scenarios could play out:

•A direct wave five rally towards new all-time highs.

•Or a larger correction before another bullish surge.

For now, Bitcoin is squeezed between support and resistance, waiting to show its hand.

•Above $112K → room for a fast move higher.

•Below $107K → signals deeper correction before recovery.