Bitcoin Elliott Wave Update: Testing Resistance, What’s Next?

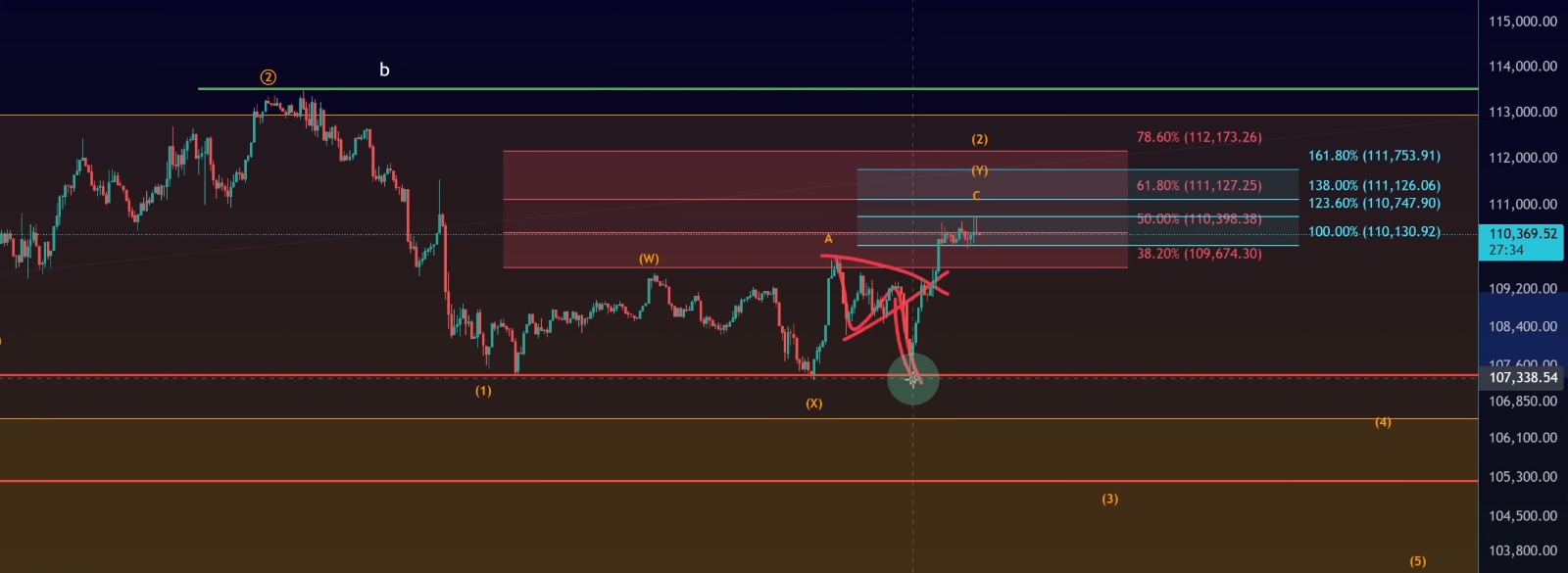

Bitcoin (BTC) has been moving within a well-defined structure over the past few sessions, bouncing back into the resistance zone after repeatedly holding key support. While the short-term action may look like a recovery, structurally it continues to align with a corrective wave 2 bounce. Let’s break it down.

🔹 Recent Price Action: Bounce into Resistance

•BTC found structural support around $107,400, which corresponds to the swing lows from July 4th and July 8th.

•Across Friday, Saturday, and Monday, Bitcoin tested this support multiple times before bouncing higher.

•The downside leg of wave B unfolded in a three-wave move, which typically suggests potential for higher prices unless strong selling pressure follows.

However, over the U.S. holiday weekend, low volume prevented any decisive follow-through to the downside. Instead, BTC consolidated between support and resistance.

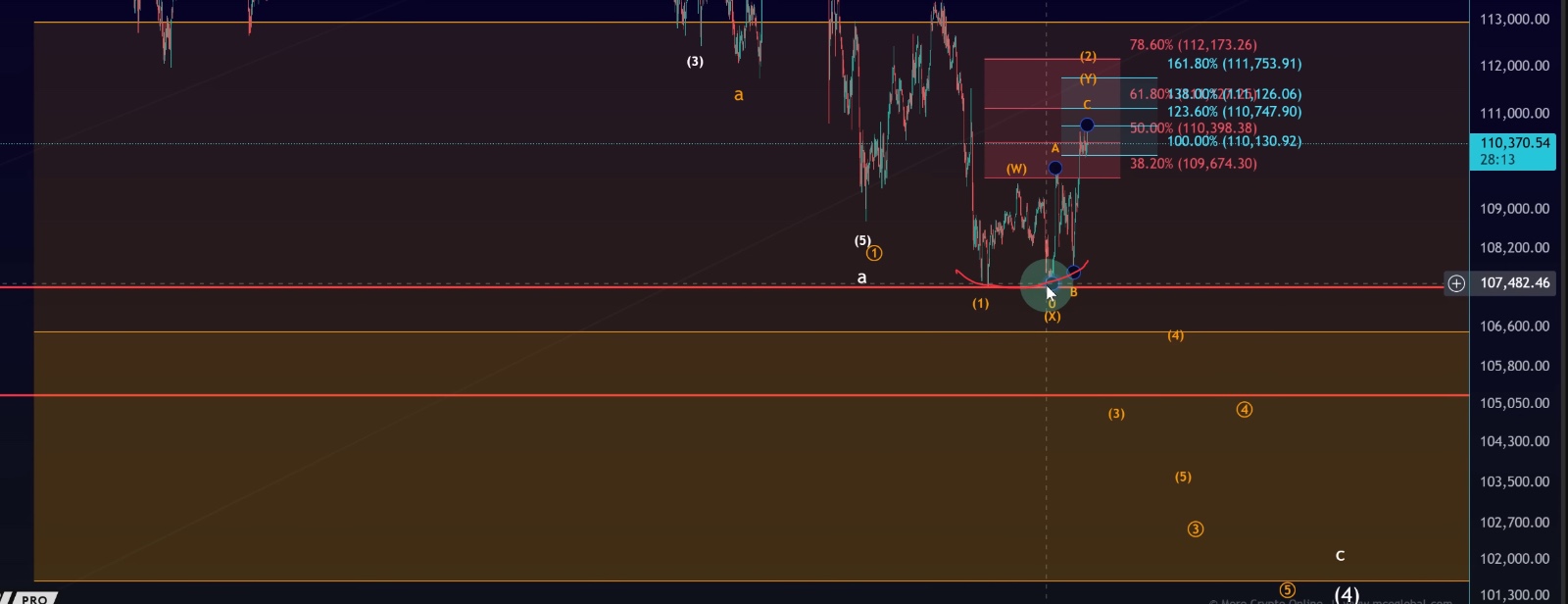

🔹 Correction Structure: From ABC to WXY

Originally, the correction appeared to follow a standard ABC pattern. But as price action developed, it evolved into a more complex WXY correction.

•This isn’t unusual during low-volume periods like long weekends.

•Yesterday, BTC completed wave C of Y, reaching the ideal Fibonacci extension zone between $110,130 and $111,750.

•This area often acts as a natural target and resistance for wave 2 corrections.

🔹 Key Resistance & Next Levels

The boundaries of this correction remain critical:

•Immediate resistance: $112,170

•A break above this would increase the probability of a larger corrective bounce.

•Invalidation point: $113,527

•Surpassing this would invalidate the current 1–2 downside structure.

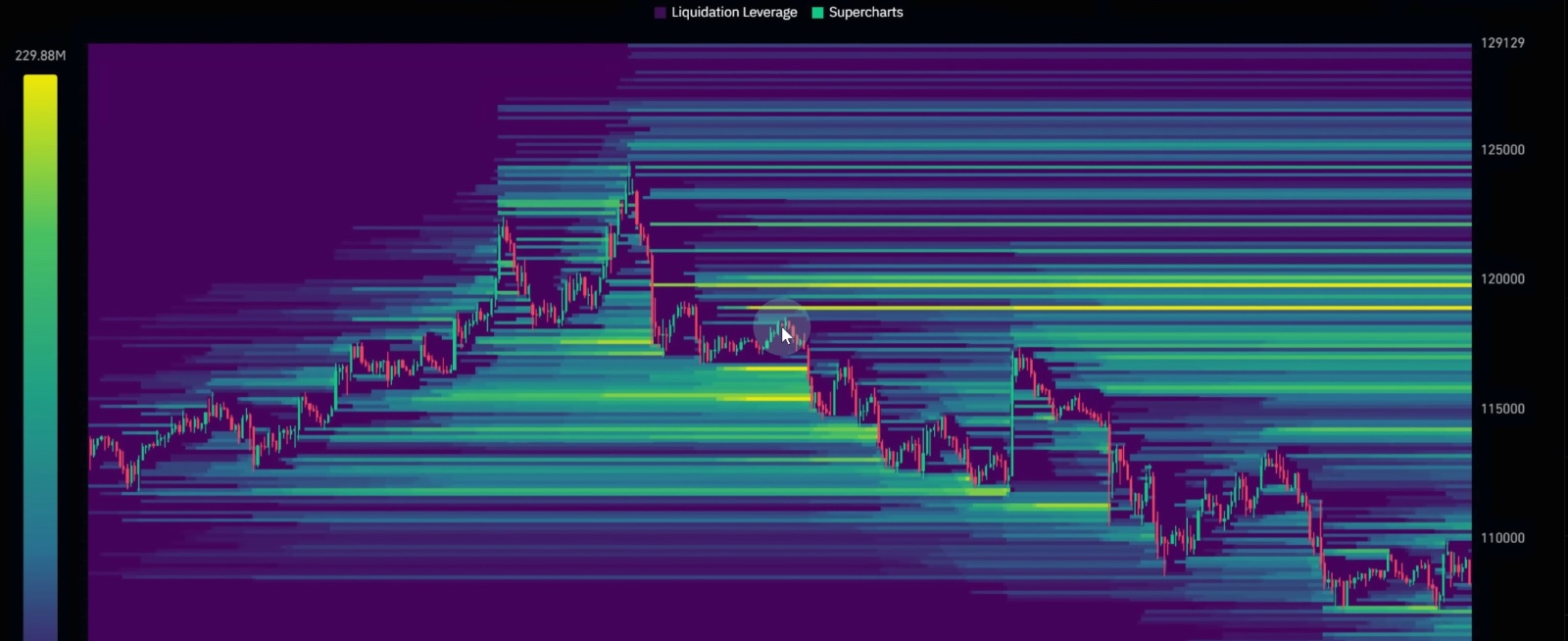

•Upside targets if resistance breaks:

•$115K (liquidity cluster)

•$117.5K – $120K (major resistance and liquidity zone)

This upper range aligns with both Elliott Wave projections and liquidity heatmaps, suggesting strong interest from market participants.

🔹 Bigger Picture

•Until BTC breaks above $112,170, the correction remains intact as a standard wave 2 bounce.

•A confirmed breakout could trigger a move toward $118K–$120K before the market decides its next major direction.

•For now, this is still a consolidation phase between strong support (~$107,400) and layered resistance above $111K.

🔎 Conclusion

Bitcoin’s recent bounce into resistance is fully in line with Elliott Wave expectations for a wave 2 correction. The next decisive move hinges on whether bulls can clear $112,170. If they succeed, the path opens toward $118K–$120K liquidity levels. Until then, BTC remains in a sideways consolidation with short-term upside momentum but unconfirmed bullish strength.